There have been some discrepancies in the precious metal markets since the start of the Coronavirus pandemic and this article looks at three examples where powerful entities have lined their pockets by benefitting from the disruption and exploiting loopholes.

The University of Sussex Business School released an analysis stating that the widespread market turmoil caused by COVID-19, meant regulators had so much on their plates that large-scale manipulation of the markets remained completely under their radar (Sussex.ac.uk, July 2020).

Precious metals revenues at the world’s 50 largest investment banks are set to double this year to an incredible nine-year high of $2.5 billion (Financial Times, September 2020) and more than $60 billion have been invested in gold-backed ETFs this year alone (World Gold Council, September 2020). So why are prices not rising?

3 Ways Precious Metal Prices Are Being Manipulated During the Coronavirus Pandemic:

- Dominance over the Futures Market

- COMEX Market Trade Data Not Adding Up

- The unusual gap between London & New York prices

1. Dominance over the Futures Market

Gold and silver spot prices are determined by the LBMA market and are made up of central banks and large commercial banks with trading desks. LBMA gold prices are defined twice a day, whereas the LBMA silver price gets set once a day. The process of setting these prices occurs through an electronic auction process referred to as the ‘London Fix’.

Within the gold and silver futures market (the biggest being COMEX based in New York City), futures contracts which span months into the future are openly traded by both commercial and non-commercial entities. The amount of physical gold and silver being traded in the futures market is represented by the ‘open interest’ held within a COMEX-approved gold and silver warehouse so that contracts which ‘stand for delivery’ can be fulfilled.

Twice a month, certain parties with long contracts have the ability to ‘stand for delivery’ meaning those parties with short contracts need to deliver the requisite amount of physical COMEX gold and silver bars. For those parties not standing for delivery, these contracts are either rolled over in the next month’s contracts or are settled in US dollars.

What does this mean?

The internationally recognised price for gold and silver is the spot price which is determined in the London OTC spot market, however, this price is heavily influenced by the price established in the futures market.

The COMEX accounts for the overwhelming majority of all gold and silver futures trading globally. The strange thing about this setup is that the same international bullion banks which operate on the COMEX, also operate in the London OTC spot market, meaning they possess massive market dominance.

Given that the futures market determines the price of gold and silver, it should come as no surprise that a large number of experts have argued that the majority of the market manipulation occurs at COMEX itself, the largest gold and silver futures market in the world.

2. COMEX Market Trade Data Not Adding Up

As many people rush to safeguard their finances using precious metals, it’s unsurprising that deliveries have ramped up. Many investors have sold their short positions, meaning a ‘short squeeze’ scenario has allowed the rapid surge in gold and silver prices.

While the COMEX claims there is enough gold and silver to satisfy current deliveries, some anomalies in the data could draw alternative conclusions.

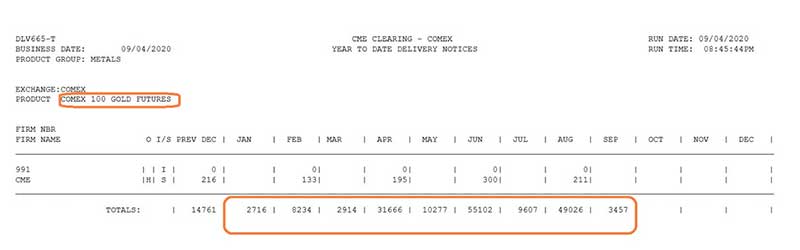

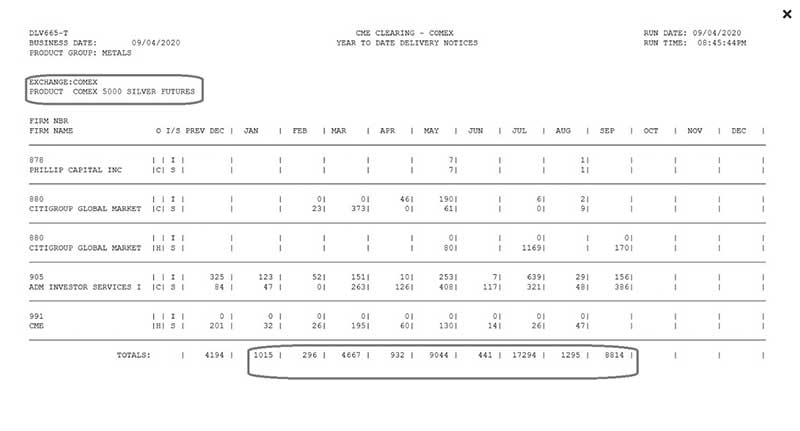

Since the start of 2020, the exchange has seen 172,000 contracts of 100oz gold delivered, valued at approximately $25.7 billion. Silver deliveries during the same time have been even more extraordinary, with 43,798 contracts of 5000 oz silver delivered, valued at $5.8 billion.

(Source: FXEmpire.com)

These are large numbers for the precious metals market and demonstrates the huge demand for physical gold and silver this year.

(Source: FXEmpire.com)

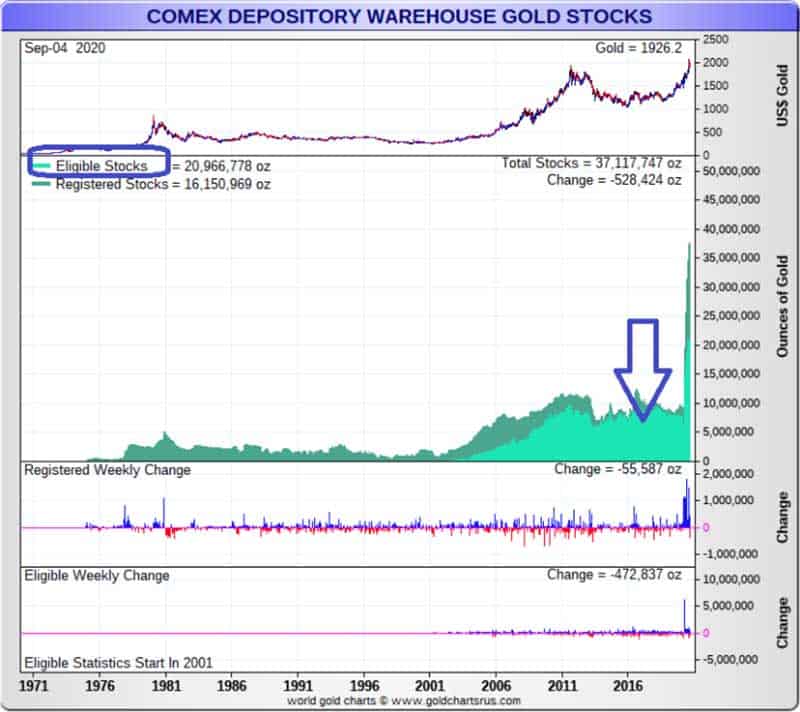

The following chart shows that the majority of gold stored in COMEX allocated to vault storage and NOT used in futures market trading.

(Source: goldchartsrus.com)

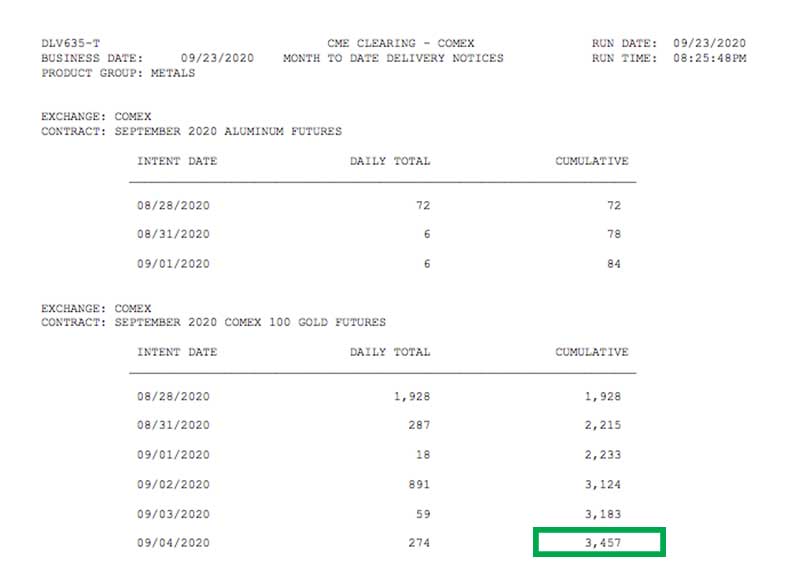

What is interesting here is that COMEX shouldn’t be able to deliver more contracts of gold ounces in a month, as they can only deliver against open contracts. In the first week of September, the CME group reporting 3457 contracts posted for delivery, which was 387 more than the 3070 that should have been available to be posted.

(Source: COMEX)

What does this mean?

Firstly, when the physical deliveries are miscounted, the paper contracts overstate the short term speculative interest in the metals versus those willing to take ownership. This means that players in the market are looking to take the metal off the hands of traders and put it into safe storage.

Secondly, and probably more importantly, it overstates the number of physical metals available for delivery on the futures market for those that want to take delivery, which basically amounts to fraud.

The errors could obviously be a mistake and the amount of paper futures contracts rolling from one month to the next is not correct. The discrepancies in daily contract numbers make us question all of the gold and silver market data reported by the CME group for the COMEX market. Who knows how long the mistakes have been allowed to exist. Just because the CME reports a number, there’s no audit published of the transactional data to guarantee its authenticity.

Ultimately, there seems to be an indication of physical gold and silver being exchanged without closure of corresponding contracts which could point to physical gold and silver being raided off the COMEX market and into safe storage.

Generally, when physical deliveries pick up, the prices of physical gold and physical silver always follow. Is there some market manipulation going on here?

3. The unusual gap between London & New York prices

Banks are set to report big profits from gold and silver trading this year. In March, disruptions to flights and refineries caused by the pandemic meant the price of gold per troy ounce in New York surged to $70 above the price in London.

This is far beyond the normal gap of a few dollars. For a number of banks with large precious metals businesses, this opened up a strange opportunity to make a lot of money.

What does this mean?

Banks that could transport gold to New York were able to benefit from the dislocation as they could deliver physical gold to settle against futures contracts trading at a higher price (Amrit Shahani, Coalition, September 2020).

The trade banks converted 400 ounce gold bars traded in London to the smaller 100 ounce bars which were then delivered to COMEX. Gold stored on the CME Group’s COMEX exchange has risen fourfold since March to more than 37 million ounces of gold worth around $69 billion. As a result, the premium for gold futures on COMEX has now fallen to about $4 over the London price of gold.

So who’s profited the most from this? This year, banks including Barclays, Goldman Sachs and Morgan Stanley have increased their precious metals trading. Barclays and Deutsche Bank did not immediately respond to a request for comment but Deutsche Bank has hired more precious metals traders. Morgan Stanley declined to comment, (Financial Times, September 2020).

4. Manipulation is nothing new

Andrew Maguire is a British commodities trader and whistleblower. Back in 2010, he presented evidence to the United States regulators about alleged fraud being committed through manipulating international gold and silver markets. He made assertions of market manipulation by JPMorgan Chase and HSBC which prompted a number of lawsuits.

In an interview with CBC, Andrew Maguire described how mysterious traders, allegedly working for bullion banks JPMorgan and HSBC, waited for most of the major markets from Shanghai to London to be closed then concentrated their dealing on COMEX. He explained how traders were trading virtual or electronic silver anonymously using algorithmic trading systems moving in and out of the futures markets in the blink of an eye. Four hundred contracts a second, each contract represents 5,000 troy ounces of silver.

Maguire described a sudden and massive wave of selling of up to 45,000 contracts which drove the price of silver down. “Investors big and small try to cut their losses and sell as the price drops.” People who had invested heavily lost everything. Then the mysterious seller just as suddenly started buying the electronic silver again. The price of silver soared as did profits for the seller. 45,000 contracts with a profit of $80,000 per contract totaled $3.6 billion for the mystery seller.”

The amazing thing is, even with all of this exposure, no regulatory or legal action has been taken as a result of Maguire’s accusations.

Conclusion

Market manipulation can be easy if you hold a lot of power. Both in the gold and silver markets, governments, central banks, commercial banks and private entities have benefited massively from this. Some single trades on COMEX, for example, have been so large, it’s shown to move prices, a clear contravention of laws on market abuse.

In March 2020, as gold should have been doing its best during the week the S&P 500 crashed, it had its worst week in eight years. This has now been pinpointed to massive short selling on COMEX gold futures. Whether regulation can help at this stage, many digital forms of investment seem to be vulnerable to these same weaknesses.

Protecting your finances with physical precious metals is often encouraged during times of uncertainty. Especially in this digital age, manipulation seems rife everywhere so having something tangible and of value is more important than ever. To start you on your journey, or if you’d like to expand your precious metal investment portfolio, order from our website today or speak to one of our friendly team members who’ll be happy to assist (sales@bleyer.co.uk).